IRS Increases Contribution Limits for Health Savings Accounts for 2019

Health Savings Accounts allow employees to set aside a portion of their salaries to save for future qualified medical expenses. These contributions become non-taxable income to the employee. As a result, employee contributions will lower an employer’s taxable payroll base and can result in a reduction of some payroll-related taxes owed.

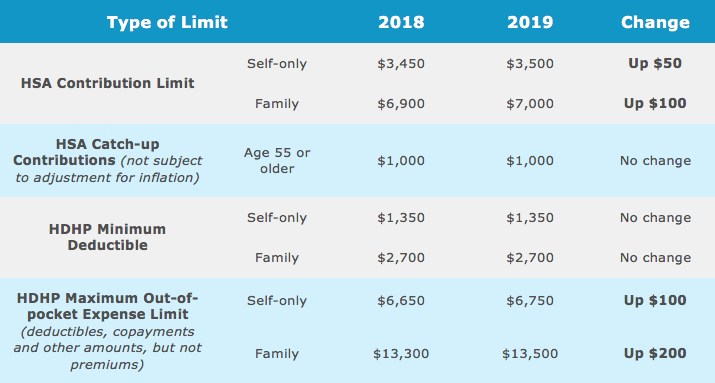

The IRS has again increased the contribution limits and for 2019 will increase by $50 for individuals, for a total limit of $3,500. For families, the contribution limit will increase by $100, from $6,900 to $7,000. Those employees age 55 or older will continue to be permitted to make a catch-up contribution of an additional $1,000. If both the employee and the spouse are age 55 or older, each can make their own $1,000 catch-up contribution, but the spouse will need to open his or her own HSA bank account for this contribution.

One requirement is that the employee must be enrolled in a high-deductible health plan to contribute to an HSA, but keep in mind that not all of these “high-deductible” plans are eligible for HSAs. In fact, at Corporate Coverage we actually discourage the use of the term “high-deductible health plan” because there are many variables in what makes one of these plans HSA qualified. The IRS has its own definitions (see chart below) but that still isn’t a guarantee of a particular health plan’s HSA eligibility. We strongly encourage employers and their employees to contact us to confirm that their current plans are HSA qualified or to review their options if they would like to change their plans.

Employee education is the key to your employees understanding the benefits of contributing to an HSA. Corporate Coverage offers employee meetings, webinars, and easy to understand educational materials, as well as HSA information conveniently housed on the custom-designed Corporate Coverage benefits web portal we can create for your company.

Remember that the HSA contributions are set per the tax/calendar year, regardless of when your group plan’s renewal date is. Since the new contribution limits take effect January 1, 2019, be sure to communicate this to your employees. Please contact us before the end of the year to learn more.

HSA/HDHP Limits

The following chart shows the HSA and HDHP limits for 2019 as compared to 2018. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older, which is not adjusted for inflation and stays the same from year to year.

Our benefits consultants stay on top of all the latest developments in the industry. Please subscribe to our newsletter to remain up to date on employee benefits options, compliance requirements and new laws that can affect your business.